Put differently, I don’t have enough cashflow to help you maximum away my personal benefits this present year

what do you need for a payday loansNew options are to secure the cash in the 401k and you may forfeit resource the new Roth IRA this present year or even significantly get rid of the latest Tsp/401k contributions and you may don’t max aside this current year. Please establish just how sometimes of those solutions is preferable to my proposition.

- Commonly these expenditures drop off between today and next season? Whether or not it couple was dutifully maxing aside both levels, and there is actually an emergent one-go out debts, this might sound right. But not, they will have to have the earnings to repay the fresh Teaspoon financing and you will max out the investment next season.

- Can i funds its Roth IRAs the following year? The new deadline getting Roth IRA share is basically this new taxation return due date. Getting 2017, the fresh Roth IRA sum deadline are (taxation go out drops for the next working day immediately following weekends and holidays). Whether it few can be so cash flow confident, I might alternatively see them utilize the very first four months of one’s next season to cover the latest 12 months Roth IRA, following maximum out the following year’s share.

Yet not, you simply cannot play with Teaspoon financing continues so you’re able to go beyond the interior Revenue Code’s IRA contribution constraints. Basically, if you have the income to help you maximum away all of your efforts, you could just take a teaspoon loan, up coming pay it back straight back. But you’d need put the Tsp financing continues for the a keen after-tax membership. If that’s the case, you’ll be getting the mortgage proceeds toward a taxable membership, at the expense of your own taxation-deferred coupons automobile. That will not sound right, often.

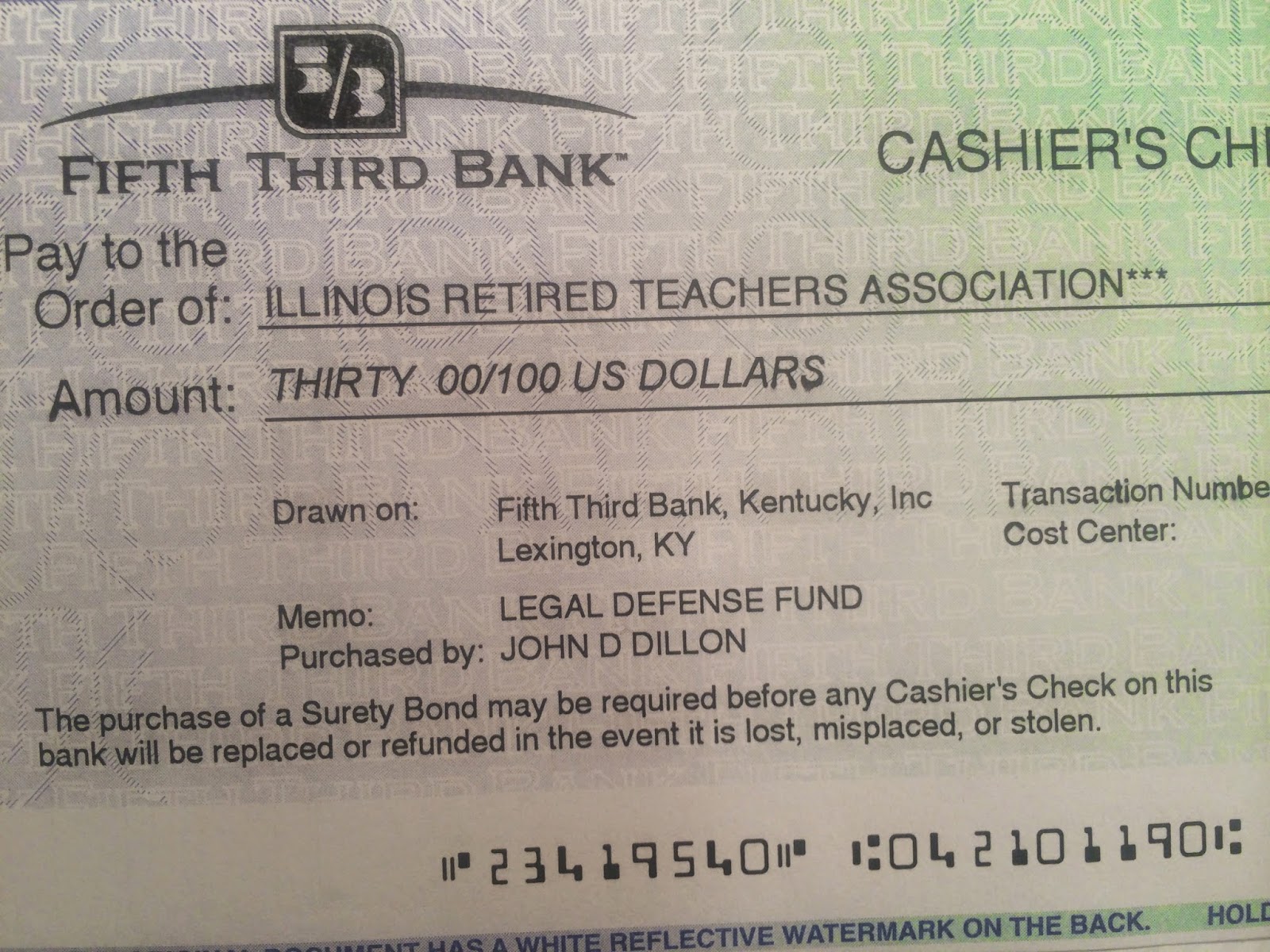

I might need a beneficial $31,000 401k loan only to piss some of you from (PunchDebtintheFace). This might be very comedy, and in actual fact appeared higher on google rankings than the past a couple of. We left they for history limited to the latest laughs worth.

As i might not concur with the requirements in this article, this individual appears to have adequate currency kepted to pay for paying the borrowed funds. Their real concern seems to be, What exactly is incorrect that have delivering good 401(k) mortgage (or Teaspoon loan, he in fact sources on the post), up coming purchasing your self the interest?

If you like that loan, but don’t have solutions, after that a tsp loan makes sense

I’d say-nothing is incorrect, if that’s their practical strategy. Then again, why would you have the trouble to do if the web impact is equivalent to getting $31,one hundred thousand on your own Tsp and you can placing it into G-money? Either:

- Your just weren’t probably invest anywhere near http://www.availableloan.net/loans/legitimate-online-loans/ this much cash in the fresh Grams-funds as part of your allocation means. Therefore, borrowing it really to expend your self right back from the G-fund speed does not make sense.

- You’re planning invest that much money in the fresh new Grams-funds as part of your method. Within this circumstance, it would be better to only contain the money in your Tsp and purchase this much regarding the G-loans.

End

But not, the risks out of credit money to earn a better capital nonetheless occur. They truly are in fact alot more ample than simply if you utilized a very antique mode, such as for example good HELOC. Earliest, your are in danger from taking a loss on your invested interest. Second, your run the risk off underperforming what you will are entitled to got you remaining the cash alone. Third, you might be jeopardizing retirement intend on which consequences. Finally, if you aren’t in a position to pay back oneself, the mortgage becomes a nonexempt shipments. A taxable distribution is actually susceptible to complete taxation and people early detachment punishment that may implement. Ironic, huh?

- Should not keeps a legal buy up against the Teaspoon account.

Let us evaluate this as to what the latest Smiths possess obtained got they remained dedicated to brand new 2040 money. By , the new L2040 fund’s 5-year mediocre was %. As of this creating, the entire year-to-big date results is actually roughly according to you to definitely matter, at nine.78%. Having simplicity’s benefit, we’ll play with the common annual go back regarding 10%. Got that $fifty,000 stayed in Teaspoon, in the a good 10% average yearly go back, it would have grown to help you $80,525 over that exact same schedule.

For folks who remain delivering rejected of the financial, following most likely the possessions is not a tremendous amount anyway. In this case, maybe you must not a tsp loan on the for example a risky financing. Whenever you can get a lender to invest in the offer, then you can maintain your money growing on your Tsp membership into an income tax-deferred foundation.

My consider is always to pull out a 12 months $eleven,000 Tsp financing on 2% by the end of the year to completely money our very own Roth IRA when you find yourself nevertheless maxing out the 2015 401k tax advantaged room.