Now the online retail monster became mixed up in student financing markets alone courtesy a collaboration with Wells Fargo

payday loans asThe web shopping giant’s pledge to incorporate “discounted” student education loans due to a new commitment with Wells Fargo elicits concerns out of individual advocates in the you’ll duping away from youngsters.

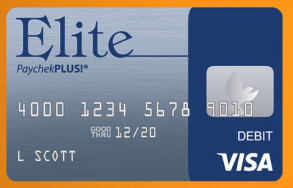

Towards Thursday, Craigs list and the banking and financial services providers announced a collaboration by which Amazon Prime Student participants might possibly be eligible for a beneficial 0.5 payment area cures on their interest for private beginner funds taken out through Wells Fargo Knowledge Monetary Services.

We have been worried about innovation and you can appointment the people in which it was — and you will much more which is regarding the electronic room, John Rasmussen, Wells Fargos head of private lending group, told you when you look at the a statement. This will be a huge chance to assemble a few high names. During the Craigs list and you can Wells Fargo, providing outstanding customer service and you may providing clients are in the middle of everything we do.

Browse “student education loans” into Amazon plus the results become headings including the Student loan Fraud while the Student loan Disorder: How well Objectives Written an effective Trillion-Money Condition

This new statement appear at a time whenever student education loans are coming significantly less than growing scrutiny from political figures concerned about university cost and you will overindebtedness. But it indicators one even yet in the present day governmental environment, shops get a hold of student loan individuals since the lucrative aim having business.

The offer are satisfied was confronted by dismay by the Institute getting University Access Triumph. Pauline Abernathy, the latest organizations administrator vice-president, told you the relationship is made to dupe children which qualify for low-interest federal figuratively speaking toward taking out more pricey private finance which have a lot fewer defenses.

Private financing are among the riskiest an approach to financing a degree, Abernathy told you. Eg playing cards, they have the greatest pricing in the event you can also be the very least manage him or her, however they are so much more hard to release into the personal bankruptcy than simply playing http://cashadvanceamerica.net/loans/school-loans-for-bad-credit/ cards and other individual debts.

Undergraduates which have government Stafford financing usually borrow at a consistent level out of simply 3.76 per cent this current year. 03 per cent having a varying rate of interest mortgage otherwise per cent to possess fixed-price funds, depending on the companys site. Abernathy plus indicated to small print into companys web site demonstrating the financial set aside the authority to modify or stop interest price offers at any time.

Alexander Holt, an insurance policy specialist in the think tank The brand new The united states, asserted that if you find yourself government financing tend to be more glamorous, you will find borrowing from the bank limitations having undergraduate people exactly who can still features unmet costs associated with attending school. And though the volume of private funds continues to grow, they still make up just a minority — seven.5 per cent — of the education loan field compared to government student education loans.

If you nevertheless you need investment to possess college or university over the government scholar financing limit, theres nothing wrong with taking out fully a personal student loan, Holt told you.

But the guy expected why Amazon — a pals hyperfocused on the brand name reputation and customer support — carry out associate alone which have individual student loans, an item who may have usually been a responsibility to have brand reputations.

Amazon is actually taking a beneficial reputational risk for a highly low payoff, he told you. Its an enormous sector. But it’s maybe not grand and it’s really always run high reputational exposure into the organizations with it.

Amazon Primary players make up more than half of all the consumers on the internet site, considering a study put out the 2009 few days.

Mark Huelsman, an elderly coverage analyst at the Demonstrations, said he would suggest a student borrower to pursue alternatives because of federal student education loans over a great deal so you’re able to shave their interest rate into an exclusive loan that have a prime subscription. But from a wider perspective, he told you the partnership between Wells Fargo plus the online store reveals just how stabilized scholar financial obligation is.

Rates with the Wells Fargo private college loans can go since the higher since 9

There is an assumption that simply such people may have in order to possibly shop online to have courses and provides or any other blogs and Amazon Perfect is a sure way to do that, theyre and browsing borrow figuratively speaking, he said. It is somewhat advising that college loans or student loan borrowers was today a niche field on their own.