CashUSA try a loan marketplace, and thus it will not in reality financing or provider fund

cash advance usa priceBasically

When you have poor credit otherwise do not have time and energy to store available for that loan, CashUSA will help you get in touch with a lender you to can be supply the finance you want. Lenders in the CashUSA community don’t require a credit check, which would-be better to qualify, but remember that you’ll probably become using a good highest interest.

CashUSA Snapshot

To find that loan, profiles normally fill in an individual software from the CashUSA site. After that, loan providers from the system review the mortgage demand and decide when the these are generally ready to focus on an individual in accordance with the advice provided.

Considering CashUSA, lenders with its circle usually do not work on credit checks into the individuals. While this renders finance way more available to people with crappy borrowing from the bank, you will want to fundamentally anticipate paying a whole lot more inside notice and you can costs if you work with a great CashUSA lender.

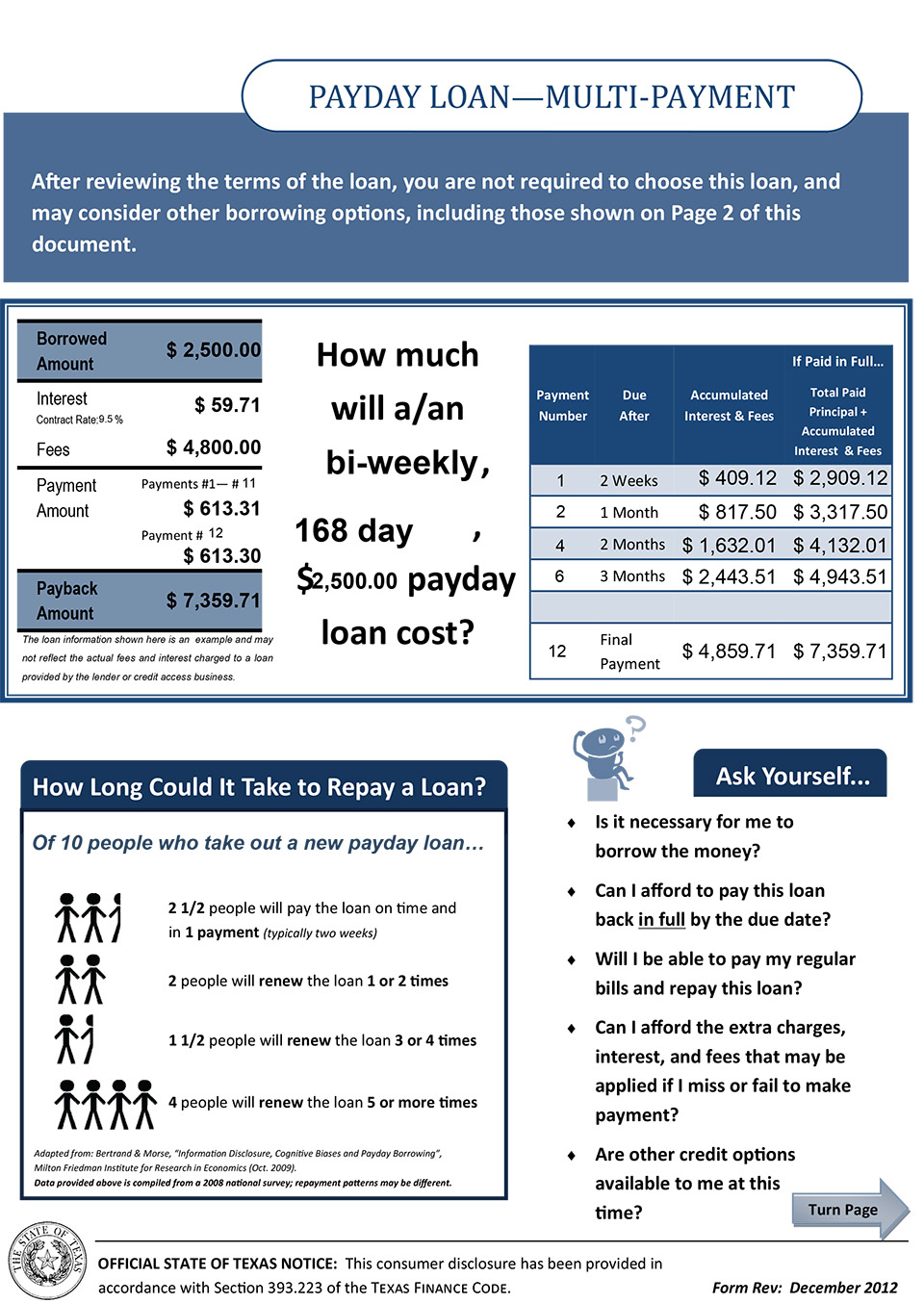

Minimal mortgage available from the system is $five-hundred, and you can profiles can use around $ten,100000. Rates begin during the 5.99% and you can go completely to % according to a beneficial borrower’s creditworthiness.

What’s CashUSA?

CashUSA are that loan linking provider otherwise industries that pairs borrowers with third-party loan providers. Since it is perhaps not an immediate lender, CashUSA will not finance otherwise service loans by installment loans Riverside itself.

And additionally banking companies or other traditional lenders, CashUSA even offers tribal funds funded because of the Local American financial institutions. Mainly because financing is actually serviced by the creditors situated on tribal lands, they generally are not necessary to conform to county regulations you to definitely manage interest rates or any other terms.

Thus, individuals whom might not be able to be eligible for a vintage financing you are going to become approved to own a tribal financing. not, such loans can come with very high-rates of interest and other too much fees, making it crucial that you fatigue all your choices just before entry an excellent consult.

By using CashUSA, individuals can be prevent supposed of lender so you can lender and you may filling in a number of different programs. This might be an enormous go out-saver if you’re quickly and require a consumer loan immediately.

Lenders regarding the CashUSA industries also offer finance as opposed to powering a credit check. This may succeed more comfortable for a borrower so you’re able to be eligible for financing, however the tradeoff is usually a high interest rate.

This new CashUSA solution is free to use, and you can individuals can get a personal loan anywhere between $500 to $10,100000. When you are financing small print are very different from the lender, this new cost several months for an effective CashUSA financing fundamentally works ranging from 90 weeks and you can 72 days.

How does CashUSA Work?

Submitting a request for financing because of CashUSA uses far the new same processes due to the fact applying for a loan through a direct bank.

Earliest, you ought to submit financing demand mode, that you’ll look for to your CashUSA web site. To get into the request means, you ought to first provide a few bits of information regarding oneself, together with your zip code, delivery 12 months, while the history four digits of your own Public Safeguards amount.

When you simply click start you will be delivered to a full online loan demand function, that will ask for more info, as well as your email, armed forces reputation, and just how much we should borrow.

Next area of the form requests for more detailed guidance, such as the name of your own employer, your revenue, the license count, and you will banking details.

Once you complete the proper execution with your information, CashUSA usually distribute it among the community of lenders, who’ll decide if they want to make you that loan render predicated on its internal lending criteria.